Contractors, consultants, and freelancers are not on the payroll of any of their clients. So, how should they be paid? That is the alternative arrangement they should take care of.

Three main options are available; establishing your own limited company, self-employment, or working under an umbrella company.

In this guide, we will not discuss self-employment in detail. But, in a nutshell, you will work for yourself completely. The invoices are done under a trading name or your own name. Also, all taxes are calculated based on the standard personal income tax rates. It is not a common approach for many people because operating a limited company involves the benefits of preferential tax rates. Also, establishing a limited company protects the personal assets from risks like costs, losses, or legal claims.

What is a Limited company?

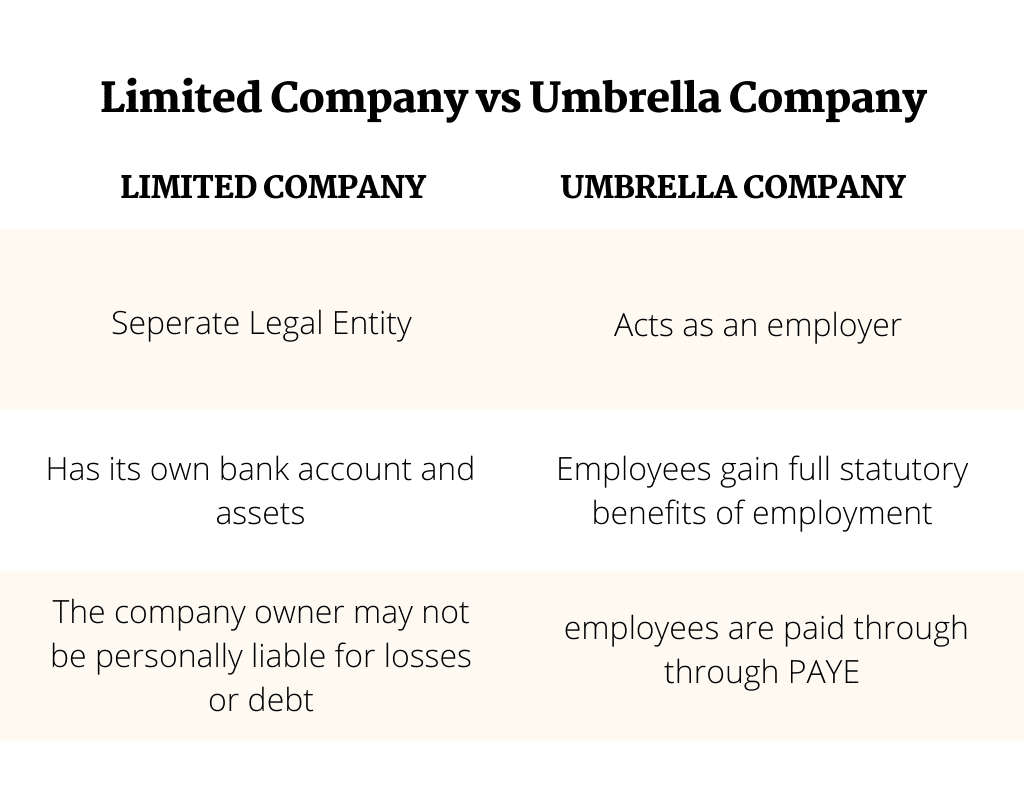

A limited company is a form of business separated legally from its owners or shareholders and managers or directors. The company has its own assets and bank account separated from the shareholders and managers. Contracts are signed between the company and its clients and all profits or losses belong to the company. In a nutshell, it is a separate entity.

The word Limited originates from limited liability because the owner or owners of the company are not liable personally for any of the company’s losses or debts. If things did not go as planned, creditors can put their hands on the company’s assets but your personal assets are completely protected.

All it takes to set up your Limited company and register it at Companies House is a small fee and reporting requirements.

Every year, the company must submit the accounts and any administrative documents. In addition, the company should commit to the Corporation Tax deadlines, which is 20% of all the profits of the company after taking into account all the expenses.

What is an Umbrella company?

An umbrella company is a company that employs contractors working on temporary assignments, usually through recruitment agencies. Your contracts will be between the umbrella company and your recruitment agency. The company acts as an employer throughout many contracts.

You will be one of the company’s employees and get paid through the PAYE system.

As one of the umbrella company’s employees, you have all the statutory benefits including holiday pay, a pension scheme, maternity/paternity pay, and sick pay. Also, some umbrella companies offer additional benefits for their employers such as benefits and reward packages, medical cover, and insurance. These benefits are not required by law.

The umbrella company’s employees are paid through the PAYE system. Therefore, no additional reporting is required. Contracts are treated as permanent employees, which means that all the taxes are deducted and provided to HMRC with every salary.

When is a Limited company a better option?

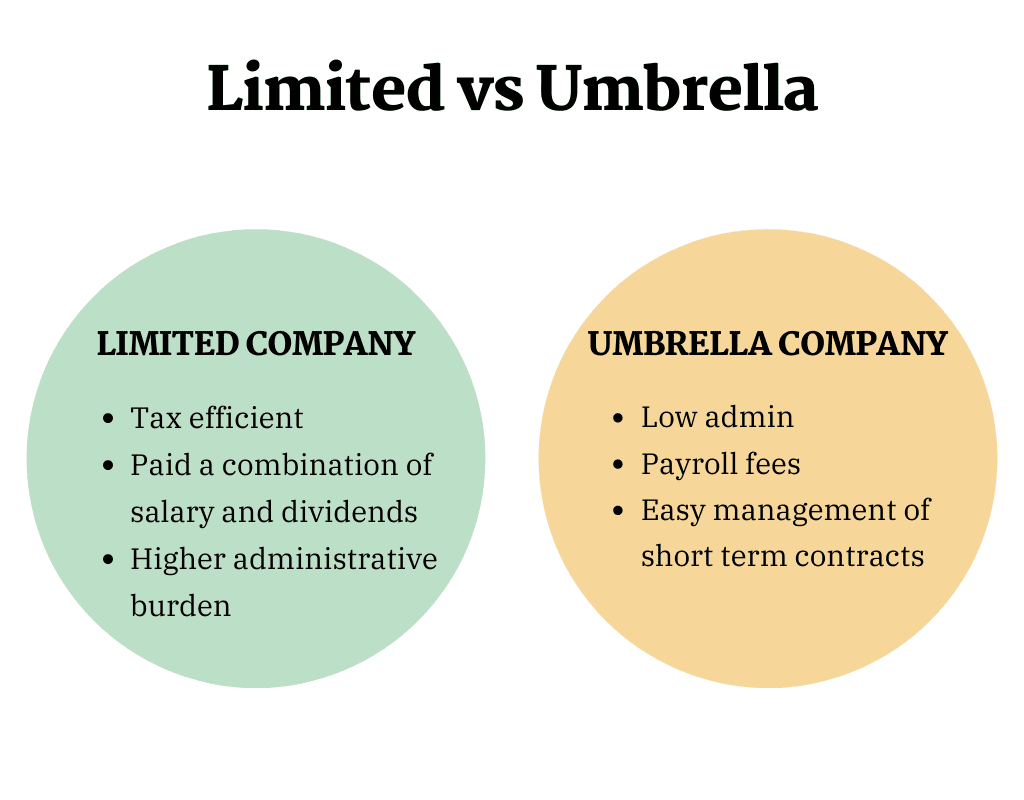

If you want the most tax-efficient structure to conduct your business, a Limited company is your best option. The system allows you to give yourself a salary and dividends to make the best out of the tax-free allowances associated with both of them. In addition, you can make tax-free pension contributions through your limited company and still leave money in your company to take in the upcoming years.

Despite being the most tax-efficient structure to get paid through, a Limited company is associated with heavier administrative burdens than an umbrella company. If you hired contractor accountants, they will help you to handle these loads. However, you will still have to keep records of all your expenses and income including all invoices and receipts. Also, all the required information for the submission of tax returns and your year-end accounts should be provided.

Administrative burdens can be handled. However, if you are a person who prefers working with zero distractions, it may not be the best option for you.

If you are inside IR35, also known as Intermediaries Legislation, the tax benefits of a limited company disappear. According to your working arrangements, you may be on the wrong side of IR35. In this case, you will be treated as a regular employee and pay National Insurance and tax at the same rates without considering your Limited company structure.

When is an umbrella company a better option?

Getting payments through an umbrella company is a better solution in most cases. The umbrella company will be responsible for all the administrative work. The company will invoice your clients for the work you have done according to the timescale agreed upon. After that, your payments will be processed via the PAYE system accounting for National Insurance and tax. Also, the company will deduct their fees according to your contract.

All you need to do is to submit a weekly timesheet; that is all the administrative work you will be asked for.

Umbrella companies are also a great option if your contracts are short-term or you are not sure that you will work long-term. If you are no longer need your Limited company, it will need to be closed down. On the other hand, if you no longer need the umbrella company’s services, you can just end your contract. After ending all employment relationships, a P45 will be given to the contractor, which should be given to the next employer.

IR35 considerations

If your contract is inside IR35, then working via your own Limited company may not be the best option and an umbrella company is highly recommended for you.

Umbrella company vs limited company

| Limited company | Umbrella company |

Status | You are the owner and director of the company | You are one of the company’s employees |

Set up | It will take a few hours to register the company with a specialist accountant. Tax registration and VAT usually take a few days to weeks. | Does not take time. Instant set up |

Legal duties | Various legal duties including financial and statutory duties | No legal duties at all |

Control | You will be in complete control of your business | Little to no control |

Ease of use | You have to take care of all administrative burdens | No administrative burdens |

IR35 | IR35 obligations are applicable. After April 2021, end clients determine IR35 status | IR35 obligations are not applicable |

Pay and taxation | · Inside IR35: Deemed payment is the same as the PAYE system. · Outside IR35: A combination of dividends and salary | Your salary is processed via the PAYE system |

Insurance | The limited company has to pay for business insurances inc. Professional Indemnity | The umbrella company’s margin includes insurance cover |

Self-assessment | Limited companies’ directors have to complete self-assessment tax returns annually. | There is no need to complete a tax return as long as you did not earn untaxed income outside your umbrella company |

Which is the best option for me?

Umbrella companies are one of the best alternatives for contractors to manage their businesses. They take care of all the administrative burdens to let you do your work. It is the best option for new and short-term contractors because it does not require a lot of commitment compared to establishing a Limited company. Contractors can join umbrella companies and leave whenever they want while, as the director of the Limited company, you cannot just leave easily.

On the other hand, running through your own Limited company is more tax-efficient than umbrella companies.