What is PAYE?

PAYE or Pay-as-you-earn refers to the income tax in the UK. It is an amount of money deducted from your earnings before receiving it. It is different from a tax return in which people or businesses have to pay their taxes on a yearly, quarterly, or monthly basis after processing their income and any other outgoings.

PAYE is the most common way to deduct taxes. Nearly all employees (full and part-time) use it to pay their taxes. However, some people who are not under any payroll, consultants, and contractors who work for someone else are excepted from this system. These individuals do not provide regular or permanent services. Therefore, they are excepted from payrolls and are not classified as employees most of the time.

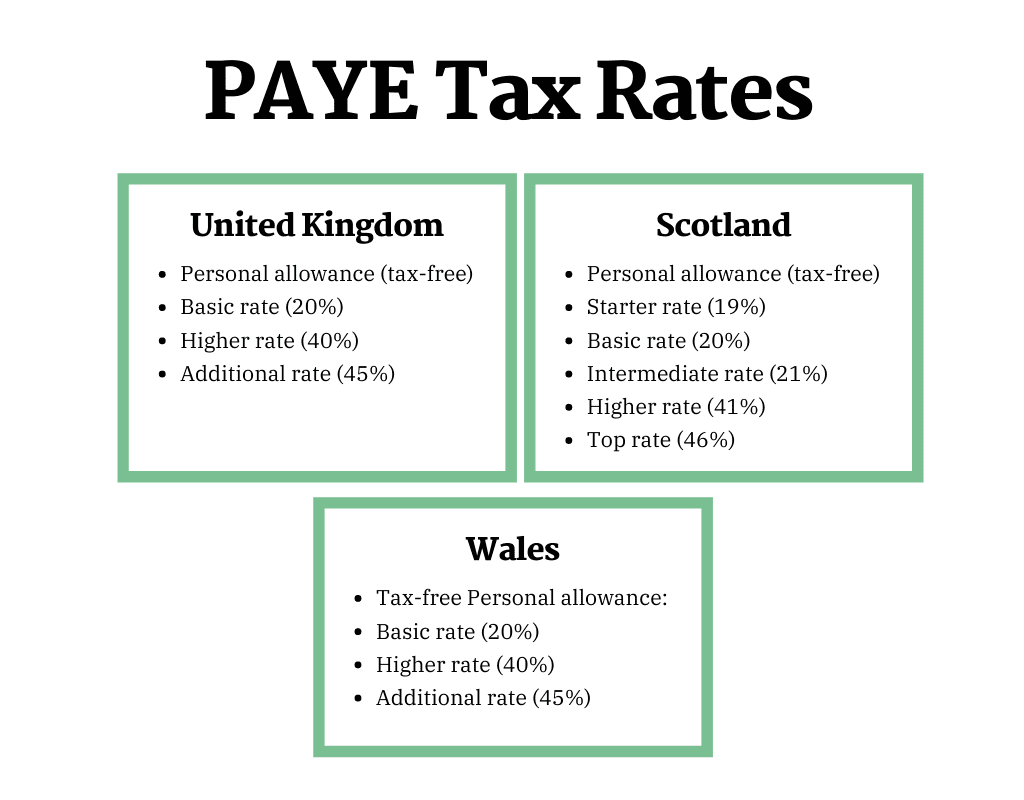

What are PAYE tax rates?

According to the annual income, the PAYE system in the UK uses these tax rates:

- Personal allowance (0%): It is tax-free if your income is under £12,500 annually.

- Basic rate (20%): If your income ranges from £12,501 to £50,000 annually.

- Higher rate (40%): If your income ranges from £50,001 to £150,000 annually.

- Additional rate (45%): If your income is above £150,000 annually.

People who live in Scotland follow slightly different income tax rates.

- Personal allowance (0%): It is tax-free if your income is under £12,500 annually.

- Starter rate (19%): If your income ranges from £12,501 to £514,585 annually.

- Basic rate (20%): If your income ranges from £14,586 to £25,158 annually.

- Intermediate rate (21%): if your income ranges from £25,159 to £43,430 annually.

- Higher rate (41%): If your income ranges from £43,431 to £150,000 annually.

- Top rate (46%): If your income is above £150,000 annually.

People who live in Wales use the PAYE system according to the following tax bands:

- Personal allowance (0%): It is tax-free if your income is under £12,500 annually.

- Basic rate (20%): If your income ranges from £12,501 to £50,000 annually.

- Higher rate (40%): If your income ranges from £50,001 to £150,000 annually.

- Additional rate (45%): If your income is above £150,000 annually.

One of the most common misconceptions is that people are taxed at one of the previous rates according to their total income. The fact is all your earnings under £12,500 are tax-free while if your earnings are between £12,501 and £50,000, the tax rate is 20%, and so on. Therefore, if you earn £200,000 annually, you will benefit from the same tax-free personal allowance as another person who earns £20,000 annually.

The previous tax rates and allowances are calculated on a monthly basis. Therefore, the tax rate can be high at a certain month and then you get a refund later if your total annual income decreased due to falling into a different tax band.

PAYE vs umbrella

Whether you are under the PAYE system or working under an umbrella company, you will be taxed the same amount of money. So, what is the difference between PAYE and umbrella companies?

Both umbrella companies and PAYE agencies hire contractors as employees. Contractors will be added to the payroll and the earnings will be processed via the PAYE system. The main difference between PAYE agencies and umbrella companies is who is going to process your income.

If you decided to work under a PAYE agency, you will be one of its employees. Your income will be processed as PAYE and you will take a salary. However, the agency will have control over your work. It will determine when you work and which contracts you take.

Umbrella companies do the same thing. They employ contractors, add them to their payroll, and process the earnings via the PAYE system. However, the main difference is that contractors under umbrella companies have full control over their work. They are free to choose when to work and which contracts to work on.

Contractors become employees whether they work with an umbrella company or a PAYE agency. They have certain rights including sick pay and holiday pay.

Employment continuity is another difference between umbrella companies and PAYE agencies. An easy-to-use tax system is offered by umbrella companies, which is not available in PAYE agencies. Contractors who want to apply for loans or mortgages can run into trouble.

Now after understanding the difference between umbrella companies and PAYE agencies, it is time to know that there is a third option.

PAYE vs self-assessment

Self-assessment is another option that contractors should consider. Regarding income tax rates (tax-free personal allowance, basic rate, higher rate, additional rate), there is no difference between PAYE and self-assessment.

The main difference between PAYE and self-assessment is when and how taxes are paid. Before getting your wages, PAYE must be paid. On the other hand, a self-assessment tax return gives you a certain period (a month, quarter, year) to pay your taxes. Contractors are paid by their clients and then they must figure out how much tax and National Insurance they will pay and do it by themselves.

Since this process is complex for most contractors because of the tax calculation troubles, many self-assessment contractors hire accountants to take care of the whole tax process for them.

In addition, self-assessment is different from both PAYE agencies and umbrella companies because contractors work under their own limited companies. No statutory benefits are available since they are not employees. They have to pay the costs if they want to take a holiday.

Umbrella companies, PAYE agencies, and self-assessment are the main options for contractors. Most contractors choose the most cost-effective option.

What is the most cost-effective option?

The three options use the same tax rates. Therefore, there is no need to focus on the most cost-effective option. What contractors need to focus on is the option that suits them and meets their contracting needs.

If you want to be independent completely, set up your own limited company. You will negotiate your contracts with clients directly, take care of your tax returns, and pay your taxes through self-assessment. In a nutshell, you will run your own company.

The second option is working via PAYE agencies. Your contracts will be sourced and secured for you but the agency will determine what contracts you will work on and you will pay your taxes via the PAYE system.

The middle ground option between PAYE and self-assessment is working under an umbrella company. You are free to choose what projects to work on and when to work. Also, you will be one of the company’s employees and get all the employees’ statutory rights. Your taxes will be paid through the PAYE system too.

Most contractors prefer umbrella companies because they combine the best of self-assessment and PAYE agencies. But, before making a decision, you should note that each option has indirect costs.

Indirect Costs

Both umbrella companies and PAYE agencies charge contractors fees for their services. These fees are for putting contractors on their payrolls, taking care of their taxes and National Insurance providing them with statutory benefits, and filing invoices for them. Also, umbrella companies allow contractors to claim back certain business expenses.

The company’s fees are taken before processing taxes. Most companies charge about £15 weekly, which is a fair price for most contractors based on the level of service they receive.

On the other hand, no fees are paid with the self-assessment option. However, most contractors pay for accountants to take care of their complex tax returns. If the accountant costs become recurring, they may increase over time.

Note that managing if you are working on a quarterly or yearly basis, it can be hard to manage your income. You need to keep track of what you are going to pay and prepare yourself to pay to HMRC when it is time to pay your taxes. You need to have a clear financial plan and have full control over your income to be able to pay the lump sum that you have to pay. That is one of the most common reasons why many contractors choose to work under umbrella companies. If you decided to do so, it is time to look for the best umbrella company to work with.

Your job may play a role

PAYE agencies are the perfect option for people looking for temporary jobs such as secretaries. On the other hand, if your work consists of multiple tasks with different clients and agencies, an umbrella company is by far the perfect choice.

Facts about umbrella companies

- You are not self-employed anymore. You are one of the company’s employees.

- Your income will divide into a gross salary and tax deductions. No dividend payments will be given to you.

- HMRC will investigate you at some point and you may be liable to pay all the taxes you owe. Penalties can be applied too.

- Tax avoidance scheme is not right. Before signing a contract with the umbrella company, make sure it has a compliant PAYE payroll service.

- All umbrella companies process your income in the same way. If the company claims that it will pay you more than others, avoid it.

- Most umbrella companies are honest and transparent. They provide services and take fees; that is all. Taxes and National Insurance Contributions are sent directly to HMRC.

- Your limited company will not be dead if you joined an umbrella company. Some umbrella companies allow contractors to keep their own limited companies.

Find the best umbrella company

Working under an umbrella company is the most beneficial option for most contractors no matter their roles or sectors. It is a popular option among contractors now because it gives contractors the freedom of self-employment and statutory benefits along with paying their taxes via the PAYE system and securing a salary for them.

However, since many contractors are choosing to work with umbrella companies, the number of umbrella companies has been increasing significantly. It is essential to compare the companies and find the one that will meet your needs and be suitable for you in the long run.