Most contractors search for the best umbrella company for them. Most umbrella companies are good. However, what you really need to ask is “which umbrella company would be the best for my needs?”. When the umbrella company meets your needs in a good working environment, it will be the best umbrella company.

Many umbrella companies have made incredible reputations over the years and become brands in the industry. The criteria differ from a contractor to another. For example, some contractors trust brand longevity while others trust transparency. We recommend working with an umbrella company with an incredible brand reputation. They will do their best to meet your needs to keep their reputation good in the industry.

Top 7 tips for choosing the best umbrella company

- Check the fee structure of the umbrella company. Fees structures differ from a company to another. Some companies are not completely transparent or fair about their fees. It is better to avoid companies that have entry and exit fees and companies which have minimum term commitments with extra fees if you decided to leave the company earlier than your contract.

Contractors who did not work with an umbrella company before should consider this point. It would be frustrating and costly if you decided to leave the company and found that you have to pay extra fees. - Do not join companies that calculate their fees based on your hourly or daily rate. When your rate increases, their fees will increase as well. These umbrella companies tend to make their fee structures complex and linked to the value of your contract, which is not fair.

- If the umbrella company allows claiming expenses without having proof of purchase or valid receipts, do not join it. When the HMRC investigates, all these expense claims will be disallowed, and you will have to pay all the taxes on these expense claims.

- Many umbrella companies emerged into the industry recently and some of them may not be well-established. Join an established umbrella company to avoid being left out without somewhere to go.

- HMRC regulations are applied to all umbrella companies. Therefore, honest, ethical companies do not promise expense claims without valid receipts or larger salaries than possible. Avoid companies that make these claims; they are not honest even if they have a good-looking website.

- HMRC investigates contractors, not the umbrella company. Therefore, you should make sure of the company’s marketing claims by asking them what these claims are based on. All companies will tell you that they are compliant and reviewed or audited externally.

- There are some online-only and fully automated umbrella companies. They are cheaper. However, working under an umbrella company is more complicated than that and at some point, you will need to speak with someone, especially if it is your first time working under an umbrella company. Call the company, have a conversation, and ask all the questions you have. For example, will I have a dedicated manager to my account? Are there service level agreements?

FAQs about umbrella companies

What is an umbrella company?

The umbrella companies employ contractors who will do tasks and assignments for the end hirer or recruitment agency. The main role of the umbrella company is to make the payments easier for the contractor after deducting any expenses including taxes, National Insurance contributions, and their fees.

What is the difference between a limited company, an agency PAYE, and an umbrella company?

- Limited company: Contractors establish their companies, pay their taxes and National Insurance contributions, and can determine whether to work inside or outside IR35.

- Agency PAYE: contractors become one of the company’s employees, which provides them with tasks to do. The agency gets a fee and pays the contractor a salary after deducting taxes. As an employee, you have certain rights such as holiday pay.

- Umbrella company: umbrella companies have the same benefits as PAYE agencies, but the contractor is free to secure contractors by themselves.

What service fees does the umbrella company charge?

Umbrella companies charge contractors fees for their services. The fees vary from a company to another but there are two main ways to charge contractors.

- Flat-rate fee: a fixed fee paid weekly or monthly.

- Percentage fee: a percentage fee according to your earnings. If your fees increase, the percentage does too.

It is better to work with an umbrella company with a flat-rate fee system to avoid paying extra money while getting the same services.

What does an umbrella company do?

The umbrella company works with three parties; the contractor, the end hirer, and the recruitment agency. Its main function is to deduct PAYE tax and National Insurance contributions before paying the worker a salary. Salaries are calculated according to how many hours or days worked via a timesheet submitted by the contractor to the umbrella company and end hirer or recruitment agency. You will become one of the company’s employees and will be provided with a payslip.

If I am inside IR35, should I work under an umbrella company?

If you have your own limited company and your contract is inside IR35, it is completely legal to operate. The major benefit of an umbrella company is removing administrative burdens.

If you are not inside IR35, you will lose the tax planning changes and the benefits of being an employee. Working under an umbrella company makes the process simpler while staying complaint.

What are umbrella company expenses?

While working under an umbrella company, you cannot ask for certain expenses such as travel and accommodation. You can submit a mileage claim if it is not under Supervision, Direction, or Control (SDC). Also, you can claim training and equipment fees used in your business only.

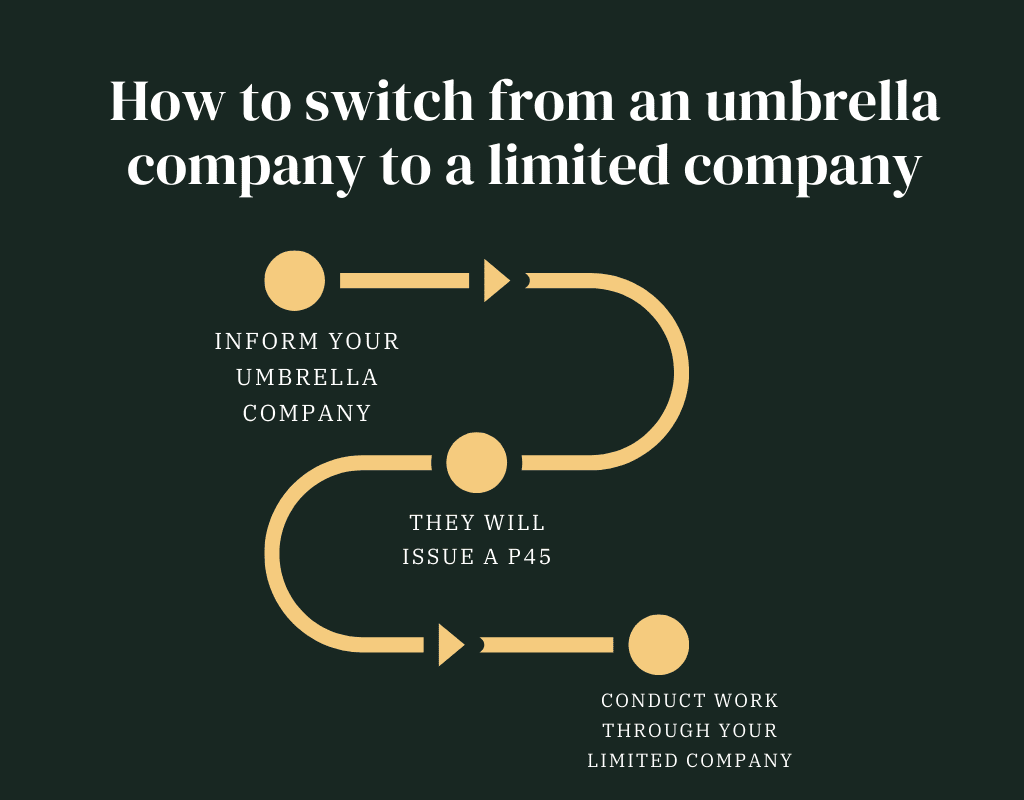

Can I switch from an umbrella company to a limited company?

Yes, you can. All you need to do is to tell your umbrella company that you are leaving. The company will issue a P45 and pay you your money. After that, you are free to establish your own limited company.

The best umbrella company may not be right for you

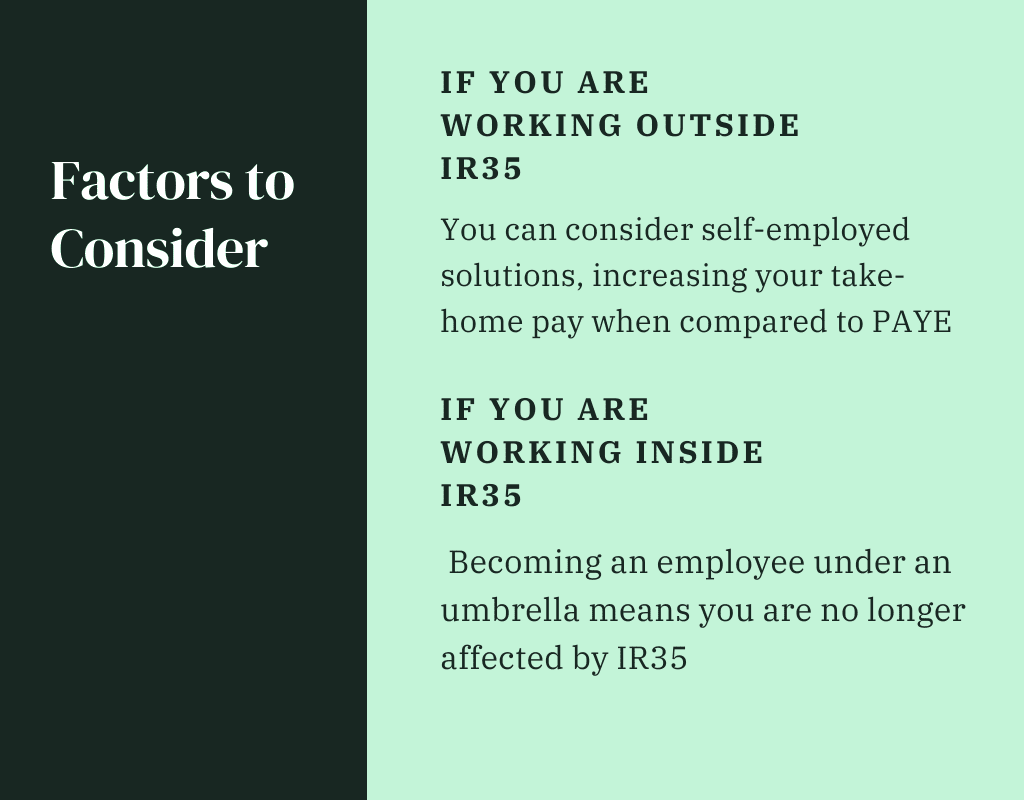

Even if you find the best umbrella company with great support, service, and fair fees, it may not be the best option for you. If you are not operating under IR35, establishing your own limited company may be more efficient regarding taxes and payments if compared to joining an umbrella company.

On the other hand, if you are inside IR35, it is up to you to work under an umbrella company or establish your own limited company. The major advantage is that you do not have to worry about being inside IR35, which is enough reason for some contractors who want to avoid any IR35 issues.