What are umbrella company costs for?

Umbrella companies hire contractors. Once you sign a contract, you become one of the company’s employees. You are charged to be an employee, yet it has many advantages.

First of all, umbrella companies will give you peace of mind about your payroll and taxes. Of course, they will take a fee in return. They take care of your invoices and deduct the taxes before sending you your home pay. Depending on your contract, your home pay will be either weekly or monthly. You do not have to worry at all about your taxes.

In addition, umbrella companies deduct other costs from your overall pay including:

- Employer National Insurance

- Employee’s National Insurance

- Income Tax

The money in your bank account is completely yours. The umbrella company took care of all the money you have to pay for HRMC.

Types of umbrella company costs

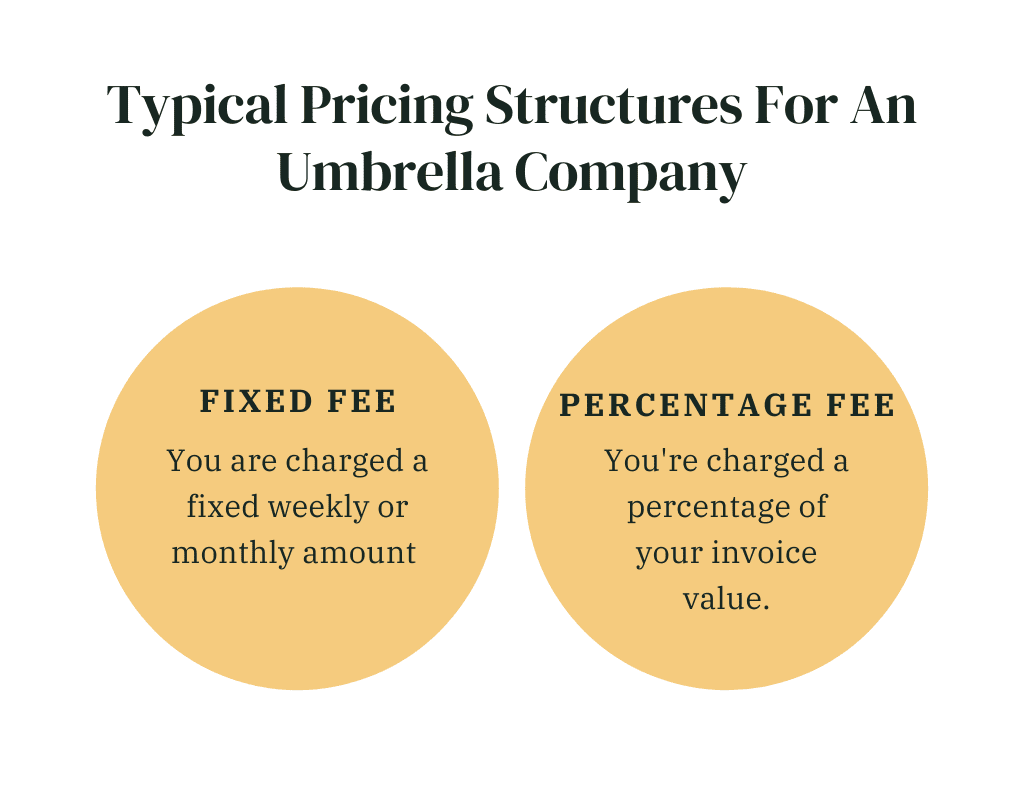

Umbrella company’s costs have two main types; fees and taxes.

The fees are either fixed-rate or percentage-based, according to your contract. Fixed rates will cost you a fixed fee on a weekly or monthly basis. Most umbrella companies charge around £25 each week or £100 each month.

Percentage-based fees depend on each invoice the umbrella company processes. If the workload is not high, this will be a better option for you. However, if your workload is high, the company may take a bigger percentage of your money. You will not get the same home pay each month or week and the amount taken from your money may be more than £100.

For example, if your contract says that the umbrella company takes 5% of your total income on a monthly basis and you earn £2,000 each month, you will have to pay more than £100 to the umbrella company as fees.

The costs of the umbrella company are not the only amount that will be taken from your total payment.

Contracts also pay other types of taxes like Employee National Insurance and income tax on their total pays. People who still think about being contractors usually overlook the fact that Employers National Insurance (ENI) is deducted from their total earnings.

In most workplaces, employers make this contribution to the employees, who usually do not notice it.

The umbrella company’s fees will not cover ENI. Therefore, the company deducts it from the gross pay of the contractor, which allows the company to minimize the amount of money they take to process your money.

When do you pay umbrella company costs?

One of the major benefits of umbrella companies’ costs is that the company charges them before processing your money for taxes and National Insurance. Therefore, contractors can include the umbrella company fees into their tax reliefs.

For example, if a contractor earns £4,000 each month, it means that the contractor is on the basic tax rate and has a tax-free personal allowance estimated at £1,042. When you earn more money above this amount, it will be subject to 12% of National Insurance and 20% of taxes. The total amount will be £4,167 on a monthly basis.

In this example, the umbrella company’s costs are £100. This amount will be deducted from the £4,000 before any deduction for taxes. Now, you have £3,900 to be taxed. After deducting 20% for taxes and 12% for National Insurance, the £100 will be £70 in your home pay. Therefore, the umbrella company will cost you less than your amount of money they charge.

On the other hand, some umbrella companies quote a net fee, which is the amount of money after taxations. If your contract says that the quote is based on a rate of more than 40% or an additional rate of 45% of taxes, you will pay more. In a nutshell, it is better to stick to compare the umbrella companies’ fees based on the gross fees.

Unexpected costs

Another point that contractors must take care of is whether the umbrella company’s costs meet all the contractors’ needs or not. None want to have a contract with an umbrella company and finds out that it is not affordable because of the added amounts of money the company needs.

First of all, beware of the one-off fee, which means that you cannot leave without paying. It is a way some umbrella companies use to encourage contractors to stay for a longer time and if you still want to leave, you have to pay to remove you from their systems. Other umbrella companies ask for fees to allow contractors to join them. These fees are for adding the contractor to the company’s payroll.

In addition, insurance is one of the common tricks to add more unexpected costs. Nearly all contractors need public and employer’s liability insurance and professional indemnity cover and many umbrella companies provide them as part of the contract. But some companies use this point to add more fees.

Some transparent umbrella companies offer many packages for contractors to choose from according to their needs and the level of services they require.

Recovering costs through umbrella companies

Another point that contractors should be aware of is how much money the umbrella company can save the contractor. Umbrella companies save a lot of time and effort by taking care of any administrative burdens or taxes. In addition, working under an umbrella company allows contractors to claim back taxation on certain expenses. However, this advantage has not been as available as it was.

Before April 2016, contractors could claim back tax on expenses that cannot be charged. During contracting roles under the umbrella company, some expenses are paid including:

- Driving: The tax-free approved mileage allowance is 45p per mile for the first 10,000 miles in the financial year and 25p per mile for any extra miles.

- Other Means of Transportation: The tax-free approved mileage allowance is 24p per mile on a motorcycle and 20p per mile on a bicycle. If you use public transport, it is estimated according to the receipt or ticket.

- Accommodation: The costs of accommodation have to be reasonable. Overnight stays and the meals are covered.

- Equipment: The expenses include protective clothes, software, and any other equipment that are essential to work. This does not cover suits.

- Training: If the training is related to your contract and you paid for it, you can claim back some of the expenses.

The 2016 Finance Bill had put certain restrictions on the expenses that can be claimed when working under umbrella companies or any other intermediaries. Trae and subsistence expenses in particular are now considered day-to-day expenses, which are not covered under tax relief.

However, your umbrella company can help you claim pre-agreed expenses related to certain jobs or contracts. These expenses are claimed back from your clients and they are not subject to taxes when processed via an umbrella company.

The Benefits of Umbrellas

Since 2016, the UK government has made paying people on incapacity benefit and employment and support allowance (ESA) easier. But if you live in a town or city, you may not know that there are more ways that you could qualify for benefits and that more and more schemes are becoming more accessible, making the process easier and faster. One of those ways is through a private company.

Since 2016, the government has introduced new Benefits.gov.uk applications to make the process simpler for everyone. These are through private companies such as Cala Ltd or Adonis and work in conjunction with the regular Gov.uk system.

Choose the best umbrella company for you

Try to find the best umbrella company for your needs since it will have a huge impact on your contracting experience. Do an extensive search and find out everything about the umbrella company before signing a contract to avoid paying more than you have to. After all, you will deal with the company for a long time so choose wisely.